Short-term wedges may occur over a few days on a daily chart, while long-term wedges may take several months to form on a weekly or monthly chart.

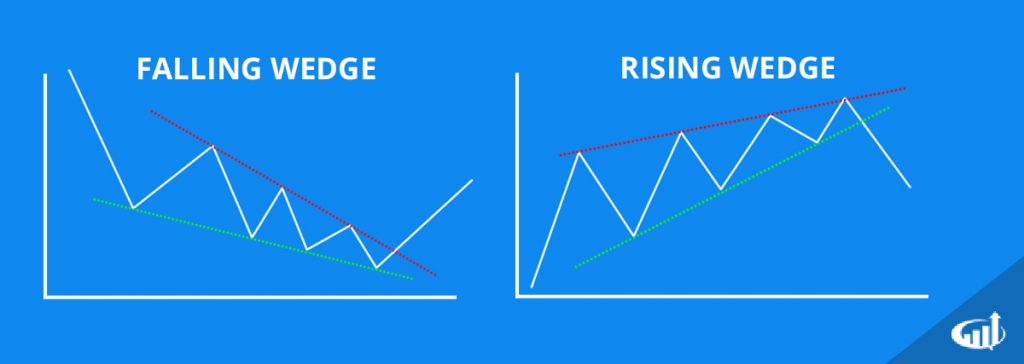

Wedge patterns can take shape over various time frames, typically between 10 and 50 trading periods, but they can sometimes last longer. Formation of Wedge Patterns Periods of Formation Traders often watch for a price break above the upper trend line as a potential buy signal. The slowing pace of the lower highs and lows in a falling wedge may signal that selling pressure is waning and buyers might be preparing to take control. The falling wedge is typically recognized as a bullish reversal pattern. The upper trend line is drawn by connecting the lower highs, and the lower trend line is drawn by connecting, the lower lows. Falling Wedgesįalling wedges occur when the price is making lower highs and lower lows, but the pace is slowing, causing the trend lines to converge. Therefore, traders often look for a price break below the lower trend line as a potential sell signal. The reasoning is that the slowing momentum in the higher highs and lows may indicate weakening demand, suggesting that sellers could soon take control. While the rising wedge may seem bullish due to the rising price, it is traditionally considered a bearish pattern. Over time, the distance between the trend lines narrows, giving it a wedge-like appearance. The upper trend line is drawn by connecting the highs, and the lower trend line is drawn by connecting the lows. Rising wedges are formed when the price of an asset is making higher highs and higher lows but at a slowing pace, causing the two trend lines to converge. They serve as dynamic support or resistance, aiding traders in making informed decisions, such as going long in an uptrend or short in a downtrend. Trend lines, drawn by connecting multiple price points on charts, are another tool used by traders to identify and confirm market trends. The strength of wedge patterns lies in their capacity to capture the tension between buyers and sellers and predict who might eventually dominate. The ability to predict a trend change in a volatile market can offer valuable trading opportunities. This pattern indicates a gradual shift in market sentiment and can signal a potential trend reversal.

#Rising wedge bullish breakout series#

It is identified by connecting a series of highs and lows on a price chart, forming converging trend lines, often resembling a 'wedge'. A wedge is a technical analysis pattern used in financial markets, illustrating an asset's narrowing price movement over time.

0 kommentar(er)

0 kommentar(er)